nebraska sales tax rate by city

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. You can print a 725 sales tax table here.

Colorado Income Tax Rate And Brackets 2019

Groceries are exempt from the Nebraska City and Nebraska state sales taxes.

. For tax rates in other cities see Nebraska sales taxes by city and county. 1 lower than the maximum sales tax in NE. The Nebraska state sales and use tax rate is 55 055.

The tax data is broken down by zip code and additional locality information location population etc is also included. The Dakota City sales tax rate is. There is no applicable county tax or special tax.

This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

The County sales tax rate is. You can print a 65 sales tax table here. The Nebraska sales tax rate is currently.

The Nebraska City Nebraska sales tax is 750 consisting of 550 Nebraska state sales tax and 200 Nebraska City local sales taxesThe local sales tax consists of a 200 city sales tax. For tax rates in other cities see Nebraska sales taxes by city and county. The Nebraska sales tax rate is currently.

Form 10 and Schedules for Amended Returns and Prior Tax Periods. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Demonstration of Filing State and Local Sales and Use Taxes Form 10 - Single Location Current Local Sales and Use Tax Rates.

The 75 sales tax rate in Nebraska City consists of 55 Nebraska state sales tax and 2 Nebraska City tax. 025 lower than the maximum sales tax in NE. Sales and Use Taxes.

For tax rates in other cities see Nebraska sales taxes by city and county. The Nebraska sales tax rate is currently. The minimum combined 2022 sales tax rate for Nebraska City Nebraska is.

Print This Table Next Table starting at 4780 Price Tax. Nebraska Department of Revenue. Our dataset includes all local sales tax jurisdictions in Nebraska at state county city and district levels.

Integrate Vertex seamlessly to the systems you already use. A sample of the 616 Nebraska state sales tax rates in our database is provided below. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

The Nebraska City Sales Tax is collected by the merchant on all qualifying sales made within Nebraska City. This is the total of state county and city sales tax rates. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

Nebraska Sales Tax Table at 55 - Prices from 100 to 4780. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. The Nebraska state sales and use tax rate is 55 055. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

There is no applicable county tax or special tax. CountyCity Lottery Keno Frequently Asked Questions. There is no applicable county tax or special tax.

The minimum combined 2022 sales tax rate for Republican City Nebraska is. Avalara provides supported pre-built integration. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

The 65 sales tax rate in Beaver City consists of 55 Nebraska state sales tax and 1 Beaver City tax. 536 rows Nebraska has state sales tax of 55 and allows local governments to collect a. The state capitol Omaha has a.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. This is the total of state county and city sales tax rates. The County sales tax rate is.

Sales Tax Rate Finder. 800-742-7474 NE and IA. The Nebraska state sales and use tax rate is 55.

The Omaha sales tax rate is. The minimum combined 2022 sales tax rate for Dakota City Nebraska is. The County sales tax rate is.

Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. The Nebraska City sales tax rate is. Did South Dakota v.

The Nebraska NE state sales tax rate is currently 55. The Nebraska sales tax rate is currently. You can print a 75 sales tax table here.

Filing Tips NebFile for Business Sales and Use Tax. The Republican City sales tax rate is. The County sales tax rate is.

Nebraska City collects the maximum legal local sales tax. Sales and Use Tax Online Filing Frequently Asked Questions. FilePay Your Return.

What is the sales tax rate in Republican City Nebraska.

States With The Highest And Lowest Property Taxes Property Tax Tax High Low

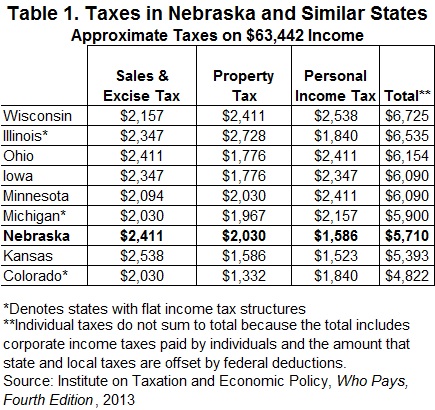

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

State Corporate Income Tax Rates And Brackets Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Updated State And Local Option Sales Tax Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ranking State And Local Sales Taxes Tax Foundation

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Lev Business Tax Income Tax Cost Of Goods Sold

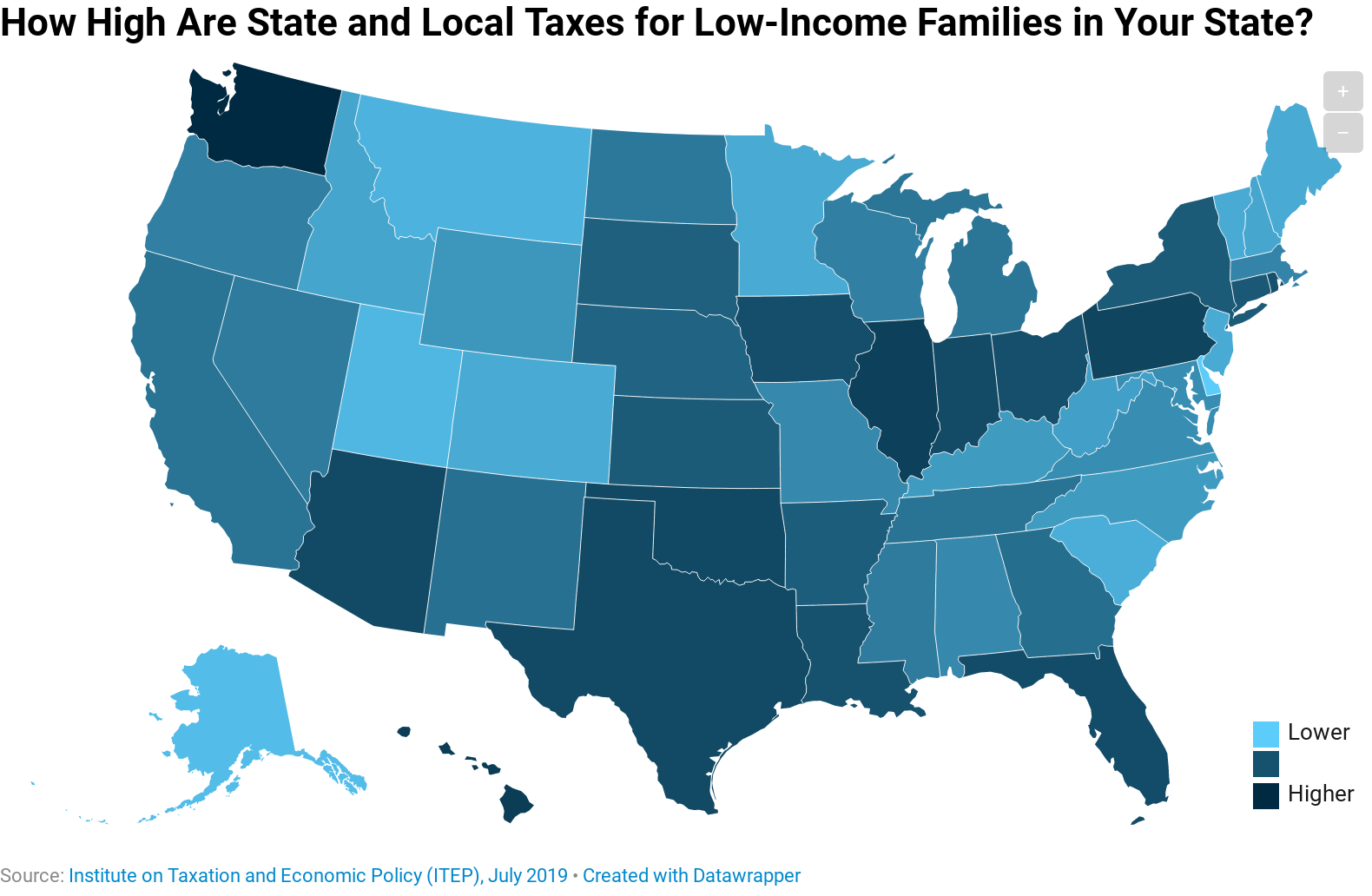

Which States Have The Highest Tax Rates For Low Income People Itep

Alabama Sales Tax Guide For Businesses

State Corporate Income Tax Rates And Brackets Tax Foundation

States With The Highest And Lowest Property Taxes

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

State Corporate Income Tax Rates And Brackets Tax Foundation

Missouri Sales Tax Guide For Businesses

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com